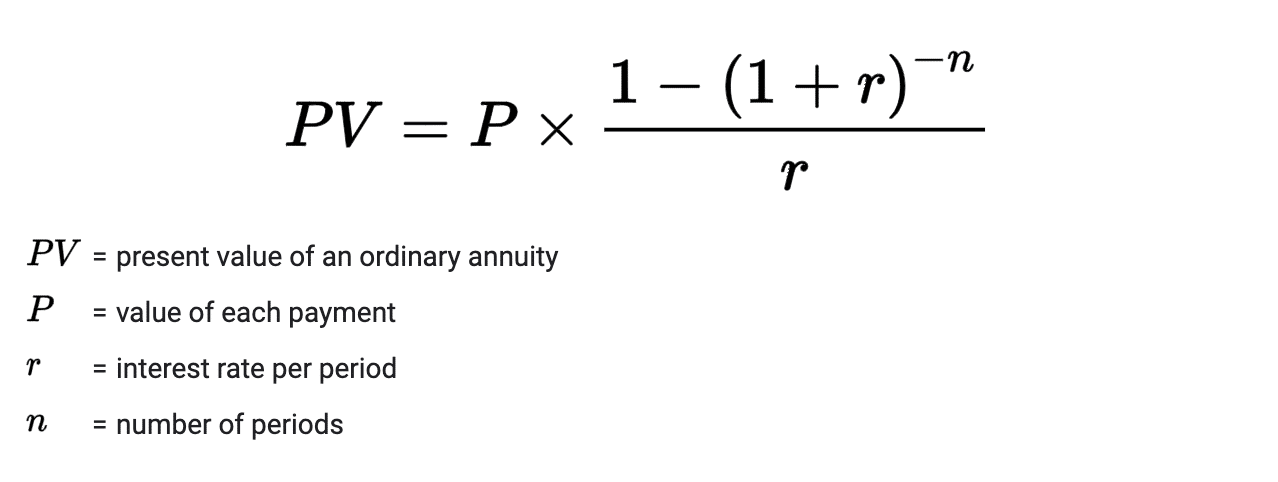

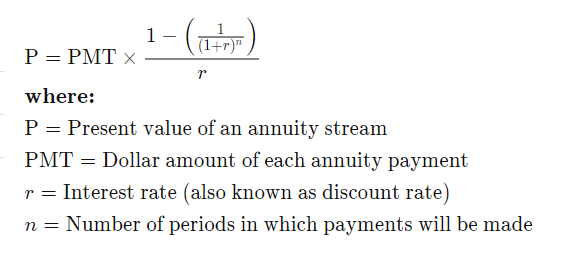

Present worth of annuity

Recall that we calculate the Present Value of an Annuity like this In this example the is equal to 10000 because thats. The present value of an annuity is the current value of future payments from an annuity given a specified interest rate.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

Input these numbers in the present value.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

. The present value of an annuity is the cash value of all future annuity payments given the annuitys rate of return or discount rate. Learn some startling facts. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

PV PMT l gi gi where. Using the above formula the present value of the annuity is. Ad The Leading Online Publisher of National and State-specific Contracts Legal Documents.

There is a formula that can be used to calculate the present value of an annuity. C 1 cash flow at first period. We just use the Present Value of an Annuity formula.

To find the future and present values of an annuity due multiply the applicable formula by 1 k to reflect the earlier payment. Ad Annuities are often complex retirement investment products. The present value of the annuity.

Present Value PMT x 1 - 1 r -n r x 1 r Where PMT is the value of the cash flows r is the constant interest rate for. Its based on the time value of money concept. The present value of an annuity is the equivalent value of a series of future payments at the beginning of its duration accounting for the time value of money - meaning.

This concept is based on the time value of money which states that. Here is the present value of an annuity formula for annuities due. If youre planning for retirement annuities may compliment your current strategy.

Ad Annuities come in many shapes sizes connect with us to learn more today. Get this must-read guide if you are considering investing in annuities. PV the Present Value.

R rate of return. You can use the following formula to calculate the present value of an annuity. The formula for determining the present value of an annuity is PV.

Begin aligned text Present value 50000 times frac 1 - Big frac 1 1 006 25 Big. The present value of an annuity is determined by using the following variables in the calculation. Ad Learn More about How Annuities Work from Fidelity.

Ad Learn More about How Annuities Work from Fidelity. PV present value of the annuity. By using the geometric series formula the present value of a growing annuity will be shown as This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1.

Because payments for an annuity due are. The formula is as follows. N number of periods.

The present value formula is PVFV 1in where you divide the future value FV by a factor of 1 i for each period between present and future dates. The present value of an annuity refers to the current total value of a persons future annuity payments. PV PMT x 1 1 r n r PMT the periodic payment r.

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Annuity Present Value Pv Formula And Excel Calculator

How To Calculate Present Value Of An Annuity

Present Value Of Annuity Due Formula Calculator With Excel Template

How To Calculate The Present Value Of An Annuity Youtube

Present Value Of An Annuity How To Calculate Examples

Present Value Of Annuity Formula Double Entry Bookkeeping

How To Measure Your Annuity Due

Annuity Formula What Is Annuity Formula Examples

Present Value Annuity Tables Double Entry Bookkeeping

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

Present Value Of Annuity Calculation Knime Analytics Platform Knime Community Forum

Excel Formula Present Value Of Annuity Exceljet

Present Value Of Annuity Formula With Calculator

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

Present Value Of An Annuity How To Calculate Examples

What Is An Annuity Table And How Do You Use One